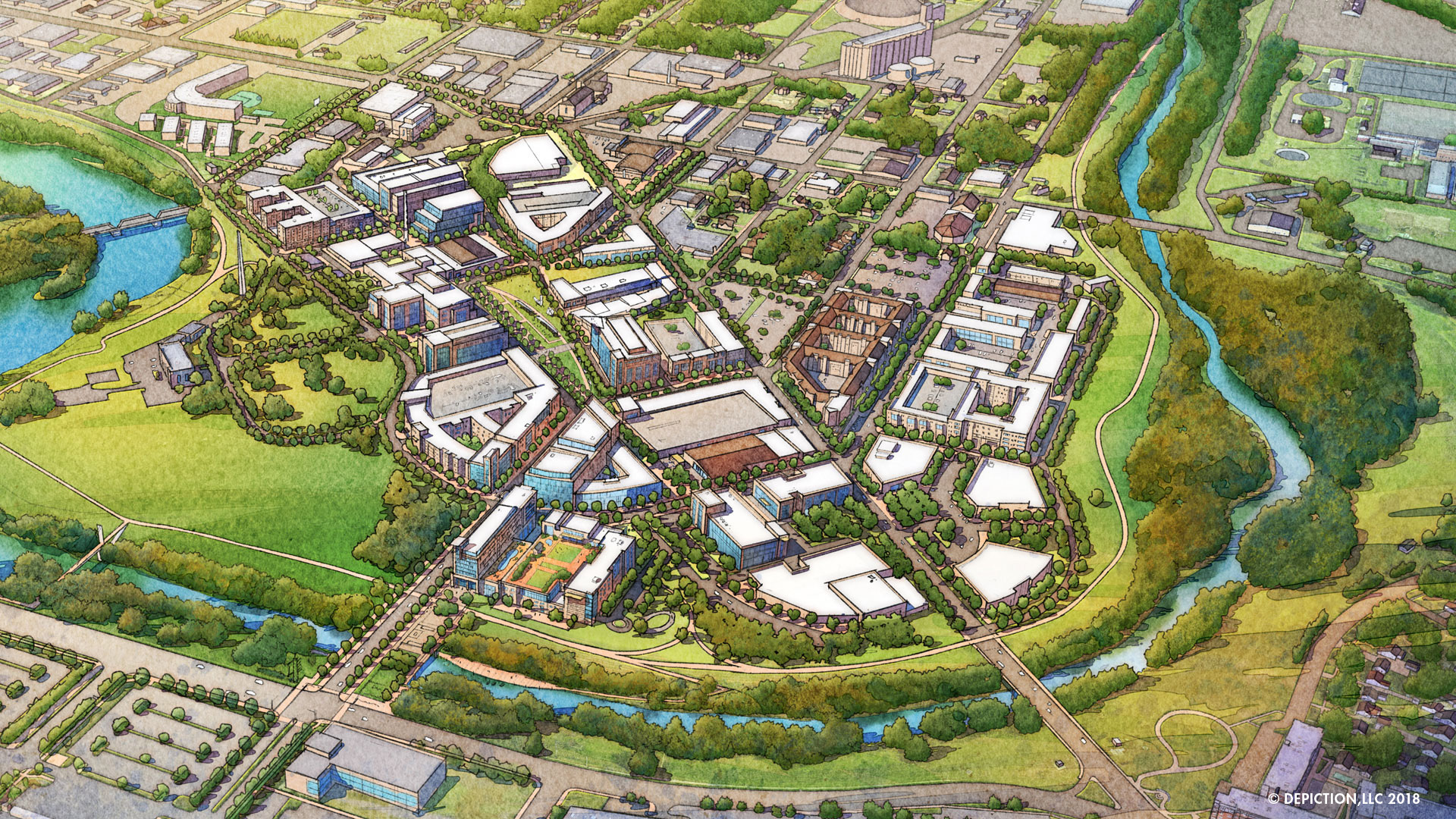

Learn about Projects for The Indianapolis Local Public Improvement Bond Bank.

Talk to us

Have questions? Reach out to us directly.

Learn about Projects for The Indianapolis Local Public Improvement Bond Bank.

Projects

Talk to us

Have questions? Reach out to us directly.